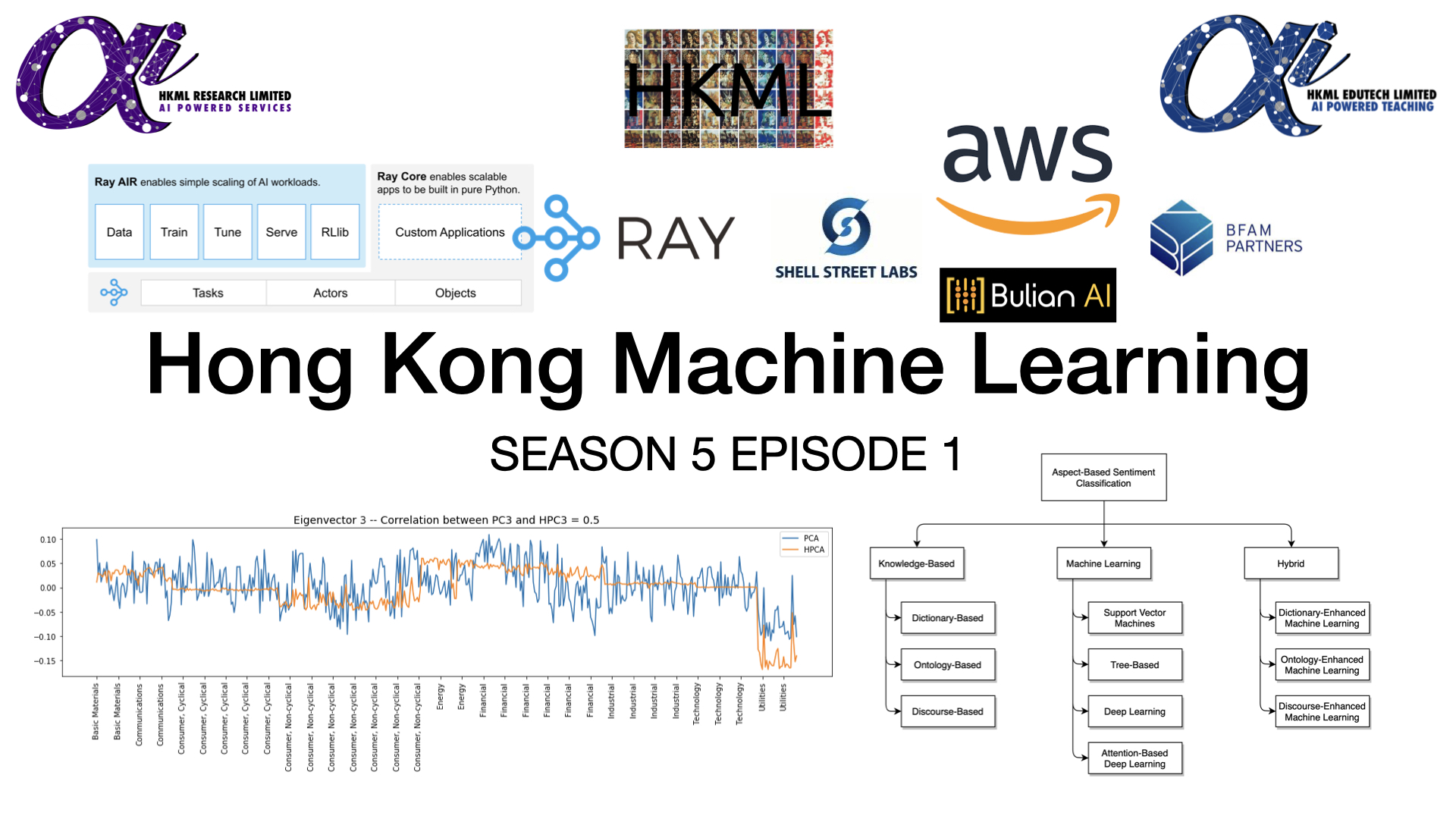

Hong Kong Machine Learning Season 5 Episode 1

22.09.2022 - Hong Kong Machine Learning - ~3 Minutes

When?

- Thursday, September 22, 2022 from 6:30 PM to 9:00 PM (Hong Kong Time)

Where?

- This meetup was hosted in-person at Amazon AWS office in Tower 535, Causeway Bay, Hong Kong. First in-person meetup in a while!

The page of the event on Meetup: HKML S5E1

Programme:

Talk 1: Aspect-based sentiment analysis

Speaker: Yanwei Cui, Michelle Hong

Abstract:

Sentiment analysis is crucial for enterprise to study the thoughts of their customers. However, a generic sentiment is not enough. Aspect-based sentiment analysis (ABSA) can further identify fine-grained opinion polarity towards a specific category associated with a target. During the meet up, we discuss the use cases of ABSA, current research on the topic, and how to implement with Amazon Sagemaker.

Talk 2: Ray: Distributed Deep Learning for Common Folks

Speaker: KaHei Chan

Abstract:

Empirally it was learned that the more compute resources is invested the better deep neural networks are trained. However, taking training beyond a single node efficiently is in itself a big engineering challenge where many data scientists are not well equipped to tackle. In this talk we will explore how Ray.io airdops concepts of distributed computing and the actor programming model to Python. And as a consequence, we will also explore the easy to use trainer classes from Ray libraries for us common folks to scale our models training to many machines.

Talk 3: AI Tech Powering a Hedge Fund

Speaker: Johan Lundin

Abstract:

BFAM Partners is a multi-strat hedge fund primarily based in Hong Kong. Behind the hedge fund there is the dedicated AI research company Shell Street Labs. Johan Lundin started working at BFAM Partners in 2018 and transitioned over to Shell Street Labs in 2020 where he leads the engineering team. In this talk he will talk about what tools and technologies that Shell Street Labs is using to power its scientific research and trading signal generators. Expect a large dose of AWS tech including Kubernetes, GPUs and various other cloud based systems.

Talk 4: Hierarchical PCA: Incorporate (fundamental) priors into PCA

(a tribute to the late Marco Avellaneda)

Speaker: Gautier Marti

Abstract:

PCA is a useful tool for quant trading (stat arb) but in its naive implementation suffers from several forms of instabilities which yield to unnecessary turnover (trading cost…) and spurious trades. In order to regularize the model, several techniques are available. We will discuss one in particular: The Hierarchical PCA (HPCA). With HPCA, we modify the empirical correlation matrix such that it incorporates information from a prior (fundamental) hierarchical classification: For example, sectors and industries for stocks and bonds; protocols, layers and use cases for cryptos. We will illustrate this presentation with some basic python code and results comparing PCA and HPCA for stocks and cryptos.

Lightning talk:

Bulian AI is an AI SaaS startup building world class software to enable organizations to create data insights with enhanced speed and privacy. We help our clients unlock 360-degree data opportunities with our Privacy Engineering APIs. Bulian AI operates at the intersection of privacy technologies and AI. Specifically, we help clients realize real world impact of synthetic data and unleash digital innovation.

Speaker: Rajneesh Tiwari leads the Product and Strategy teams at Bulian AI. Before founding Bulian AI, he built multiple machine learning systems at Novartis, Ericsson, and various research-focused startups in India. He had more than a decade worth of experience in building ML systems delivering high impact for customers. Along with pursuing his MS from Georgia tech, he is also a very active on Kaggle and is a practicing Kaggle Master (top 1%) with multiple Kaggle victories under his belt.

Video Recording of the HKML Meetup on YouTube

- YouTube videos: